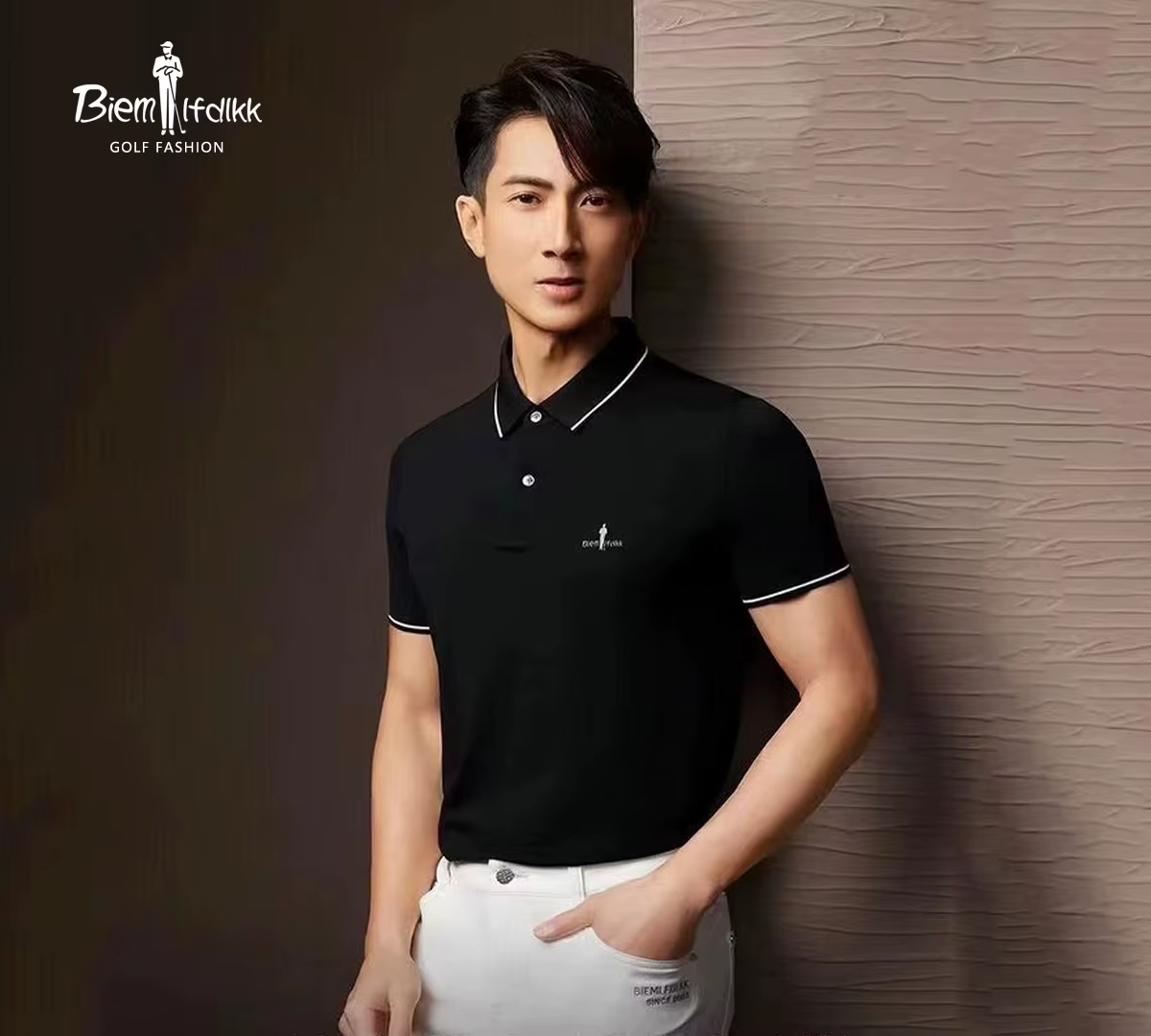

We invested in a Chinese sports apparel brand with a quirky name – Biem.L.Fdlkk, Biyinlefen or Biyinlofen.

Biyinlofen was founded in the early 2003 by Xie Bingzheng and has since grown into a high-end golf-apparel franchise with over 1,000 stores in China.

You can view the full presentation here.

EXECUTIVE SUMMARY

The past decade has seen Chinese apparel brands such as Anta Sports, Li Ning, Bosideng and Biem.L.Fdlkk win market share from foreign brands and gain more credibility with domestic consumers.

We believe Biem.L.Fdlkk has an emerging moat in its sub-apparel category driven by its focus on quality, innovation, discipline and long-term culture. This is evident in its 50%+ market share in golf apparel t-shirts in China.

Biem.L.Fdlkk has organically grown both revenue (20% CAGR) and operating profits (21% CAGR) over the past 10 years and remained resilient during the pandemic. Unlike other Chinese-listed peers, Biem.L.Fdlkk grew earnings in 2022.

Its founder, Xie Bingzheng, has led the group over the past 20 years and recently launched an ambitious plan to grow the group’s revenue by 10-fold over the next 10 years.

We view Biem.L.Fdlkk as a focused, high-quality and disciplined apparel group that will continue benefitting from the rising Chinese middle-class consumer, apparel premiumisation and China-Chic trends.

Biem.L.Fdlkk trades at a forward multiple of 19x P/E and we believe its net income can grow above 20% CAGR over the next 4 years which is undervalued both intrinsically and relative to its domestic and international peers.